Incorporation Services

Incorporating Your Business In Singapore Has Never Been Easier

AG is an award-winning mid-tier accounting firm that has been trusted to help many small- and medium-sized businesses and multinational corporations successfully incorporate in Singapore.

We offer the total package: a 360° solution that makes us a “one-stop-shop” for all your business needs and services. Our dedicated experts have extensive experience to guide you through the process step-by-step. Before you know it, you will be ready to start doing business in the Lion City and achieve the success you desire.

Our incorporation services will cover all your needs:

Why Choose Our Company Incorporation Services?

Guaranteed Bank Account Opening

Hassle Free

All-in-one Solution

Quick & Efficient

Many corporations want to enter the Asian market, notably Singapore, which is often regarded as Asia’s premier economic hub. New company incorporation in Singapore can be difficult without the correct help and direction.

At AG, we have significant expertise and professional understanding of the business sector to assist enterprises — from tiny start-ups to major multinational organisations – in effectively incorporating. Our skilled consultants are committed to your company’s success; we will collaborate with you to understand your needs and provide customised solutions to help you reach your goals.

In addition to incorporation services in Singapore, we provide a comprehensive suite of services that will cover all areas of your company’s registration and administration. We work with you every step of the process to give as much assistance as you require, handling all business registration paperwork so you can free up your time and energy to manage the complexity of forming a company in Singapore. By handling your back-end incorporation needs, you can focus on strategic planning and business operations to help your firm flourish.

Rest assured that we will be there for you every step of the way, as continual technical assistance is critical. You will have peace of mind knowing that your firm is in compliance with regulatory regulations and is up to date on market changes. With our skills, knowledge and top-rated services, you can start and build your business with simplicity and confidence.

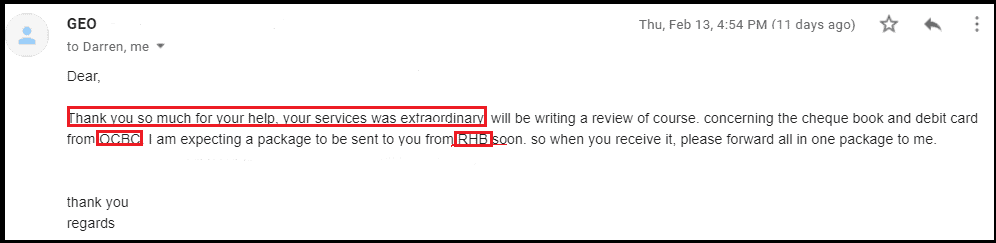

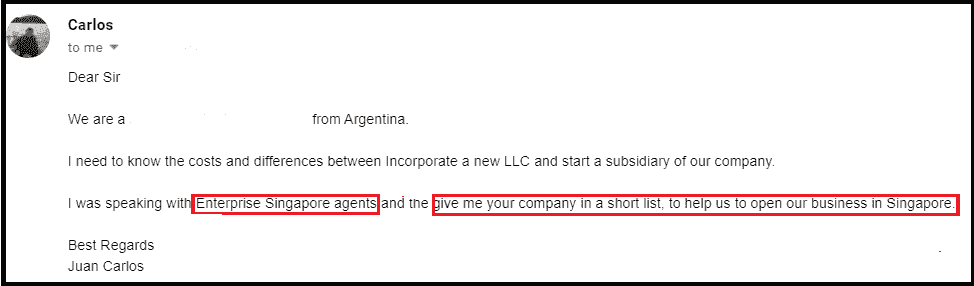

“Successfully set up a company for a foreign client with 2 multi-currencies bank accounts”

“Recommended by Enterprise Singapore (government agency) to help foreigners in company set up “

Company Registration Service Package

Package |

|

S$600 |

|

| Pte Ltd Company registration | Yes |

| 12-month nominee company secretary | Yes |

| Preparation of annual general meeting (AGM) | Yes |

| Preparation of annual return (AR) | Yes |

| Company registration charges by Government(S$315) | No |

| AR filing charges by Government (S$60) | No |

Recommended Banks for Company Incorporation

Selecting the right bank to open your corporate account is a pivotal step in the company registration and business incorporation process, laying the foundation for your enterprise’s financial health and facilitating smoother transactions, compliance, and growth opportunities. Here are banks you can consider partnering with:

Company Registration Process

Our Boardroom Facility

We have conducive, dedicated meeting rooms designed to foster productivity and collaboration, providing the perfect setting for strategic discussions and decision-making.

Tips For Company Incorporation in Singapore

During the formation process, many entrepreneurs make the error of failing to examine whether company structure is most suited to their firm, i.e. sole proprietorship versus Pte Ltd.

In the long run, this will have a substantial influence on the company’s tax and business plans.

For example, with a taxable income of S$300,000 in YA2017, the effective tax rates for a sole proprietorship and a Pte Ltd firm are 13.5 per cent and 5.7 per cent, respectively, if certain conditions are satisfied.

Sound brand strategy should begin as soon as a firm is formed. A good company name makes a strong first impression and helps you stand out from the crowd.

A good company name should be upbeat and simple to remember. If you’re struggling with your corporate branding, trust AG to incorporate your company and serve as your branding counsel to maximise the value of your firm.

A new start-up firm in Singapore is entitled to a complete tax exemption of up to S$200,000 for the first S$300,000 taxable income.

However, one of the exemptions for this condition is that the firm has no more than 20 shareholders and that at least 10% of the company shares are held directly and beneficially by an individual.

Certain enterprises are under the purview of regulated industries. As a result, before a company may be registered, it must first get an appropriate business license.

Not Sure Where to Begin?

If the journey of registering your company and initiating the business incorporation process seems daunting, it’s crucial to reach out to a reputable and experienced accounting firm like AG. With extensive experience in accounting and auditing services across various industries, our team is equipped to guide you smoothly through every step, ensuring your business foundation is solid and compliant.