Embarking on the journey of Singapore Company Registration is a pivotal step for entrepreneurs aiming to tap into the vibrant and business-friendly environment of Singapore. Recognized globally for its robust economy, strategic location, and conducive regulatory framework, Singapore presents a compelling case for business incorporation. This comprehensive guide aims to navigate through the intricate process of registering a company in Singapore, providing entrepreneurs with the knowledge and insights required to make informed decisions.

Understanding the Basics of Singapore Company Registration

The Singapore Company Registration process is designed to be straightforward and efficient, reflecting the city-state’s commitment to fostering business growth and innovation. However, the decision to register a company in Singapore should be underpinned by a thorough understanding of the various business structures available under the Company Registration Singapore system, each offering distinct advantages and implications for liability, taxation, and operational flexibility.

Selecting the Right Business Structure

A critical initial step in setting up a company in Singapore is choosing the most appropriate business structure. This decision is foundational, impacting not just the immediate process of Company Incorporation in Singapore but also the long-term success and scalability of the business.

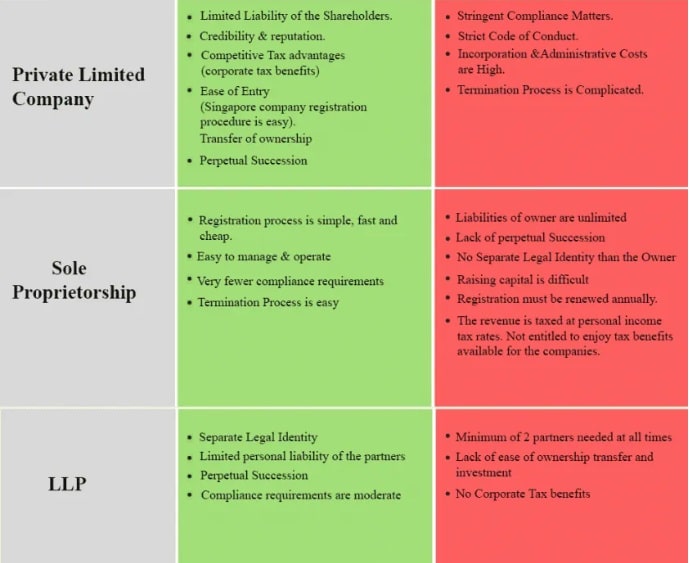

Advantage and Disadvantage of Pte Ltd vs Sole Proprietorship vs LLP

- Sole Proprietorship: This is the simplest structure, ideal for individual entrepreneurs. It allows for quick setup and full control over business decisions. However, the key drawback is the unlimited liability, where personal assets can be at risk, a significant factor to consider under the Singapore Company Registration framework.

- Limited Liability Partnership (LLP): An LLP, another structure available through Company Registration Singapore, combines the flexibility of a partnership with some benefits of corporate structure, such as limited liability for its partners to a certain extent. It is suitable for professionals looking to offer their services jointly under the Singapore incorporation regime.

- Private Limited Company (Pte Ltd): The most popular choice for Singapore Company Structures, a Pte Ltd offers limited liability, potential tax advantages, and an enhanced corporate image. It is the preferred structure for businesses that plan for growth and scalability within the Company Registration ecosystem.

Incorporation Documents to Register Company in Singapore

As per ACRA rules, your Agent or Singapore company registration services provider is responsible for the identification, collection, and verification of the details of the intended shareholders and directors in your company.

Here is a list of incorporation documents you must submit to ACRA.

- Company name registered with ACRA

- A brief description of business activities and SSIC codes

- Details of Singapore registered address of the company

- Particulars of shareholders

- Particulars of directors

- Particulars of company secretary

- In addition:

- Foreign Individual Entrepreneurs must submit a copy of their passport and residential address proof (overseas)

- Foreign Companies must submit Memorandum & Articles of Associations

- Singapore Residents must submit a copy of their Singapore identity card

Breakdown of ACRA’s Official Processing Charges:

- Reservation and Registration of Company Name: S$15

- Formal Incorporation of the Company in Singapore: S$300

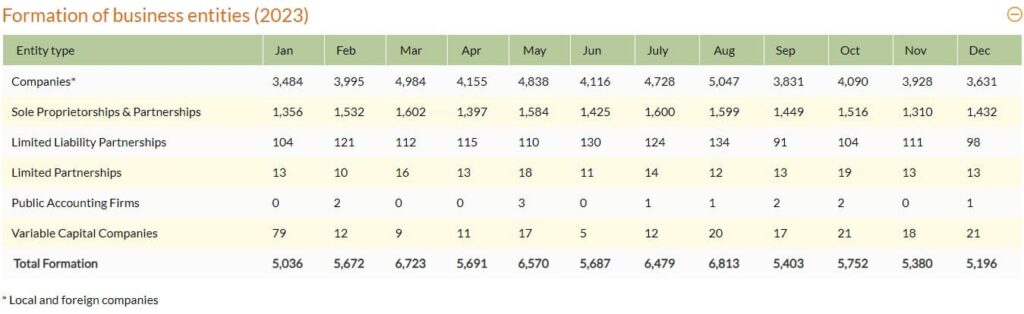

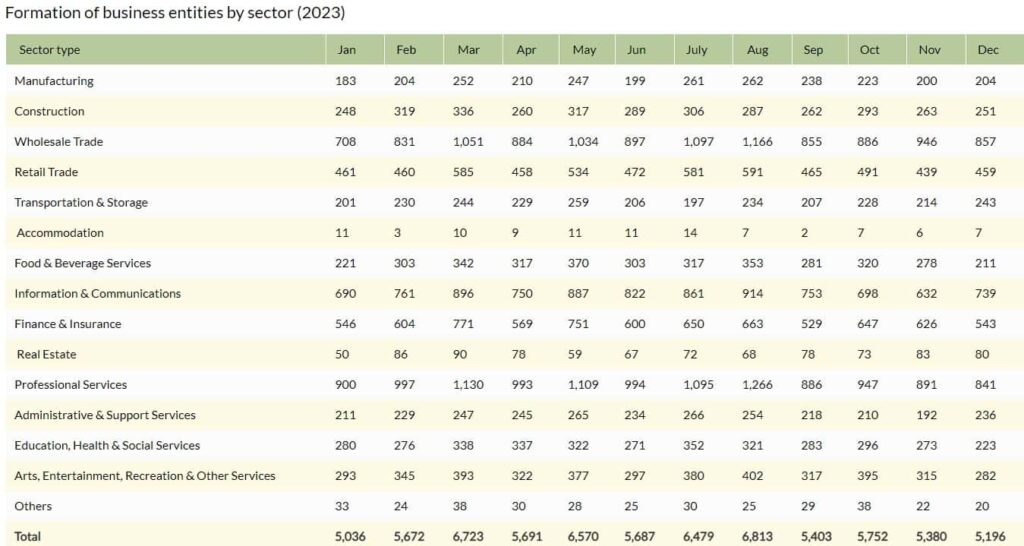

Analysis of Singapore business entity count in 2023:

(source: 2023 Singapore Business Entity Statistical Highlights)

Based on the above analysis, Private Limited Companies constitute the majority of the entities counted.

- Reasons to Establish a Private Limited Company (Pte Ltd) in Singapore:

- Optimal management of risk, liability, business scaling, and brand image.

- Preferred for its credibility, scalability, and robustness.

- Offers a distinct legal identity.

- Shareholders’ liability is limited to their share investment.

- Potential for high tax efficiency with proper structure.

- Allows 100% foreign ownership of shares.

- Open to any individual over 18, regardless of nationality.

- Considerations and Compliance for Pte Ltd Registration:

- Enhanced credibility might require consulting an expert for businesses with minimal risk.

- Additional compliance includes preparing accounts, filing annual returns, conducting audits, and appointing an auditor, a company secretary, and a local director, which could increase costs.

- Key Requirements for Company Setup in Singapore:

- Company Name: Must be approved and registered with ACRA.

- Directors: At least one director who is a Singapore Citizen, Permanent Resident, or EntrePass holder.

- Shareholders: A minimum of 1 and a maximum of 50 shareholders.

- Registered Office Address: A local address in Singapore is required.

- Company Secretary: Must appoint at least one within six months of company formation.

- Initial Paid-Up Capital: A minimum of S$1 is required.

- Auditor: Appoint at least one within three months of registration, unless exempted.

Key Considerations for Successful Entity Formation in Singapore

Financial Planning and Initial Investment

An often-overlooked aspect of Singapore Company Registration is the financial planning and initial investment required to get the business off the ground. While Singapore Company Registration offers various benefits, entrepreneurs must be prepared for the financial commitments associated with their chosen business structure.

Understanding Tax Obligations

Tax considerations are a significant aspect of Singapore Company Incorporation. Singapore’s tax regime is favorable to businesses, with attractive corporate tax rates and various exemptions available. Entrepreneurs should familiarize themselves with these tax obligations and benefits as part of their business formation planning in Singapore.

Leveraging Government Incentives

The Singapore government offers a range of incentives and support schemes to businesses, particularly in sectors it aims to develop. As part of the Singapore Company Formation process, identifying and applying for relevant incentives can provide a substantial boost to your business.

Intellectual Property Protection

Protecting your intellectual property (IP) is crucial in today’s competitive business environment. The Singapore Company Registration process should include considerations for securing your IP rights, ensuring your business can build and maintain a competitive edge.

Expanding Your Business Post-Singapore Company Registration

After successful Singapore entity formation, the focus shifts to growth and expansion. This involves strategic planning, market research, and possibly, scaling your operations internationally. Singapore’s strategic location and business-friendly environment make it an ideal launchpad for regional and global expansion.

Building a Network

Networking is invaluable in the business world. Post-Singapore Company Registration, engaging with industry associations, trade bodies, and other networking groups can provide essential insights, opportunities, and support.

Continuous Compliance

Maintaining compliance with Singapore’s regulatory requirements is an ongoing responsibility for businesses. Regularly reviewing and updating your compliance status is crucial to avoid penalties and ensure smooth operations.

Embracing Innovation and Sustainability

Innovation and sustainability are becoming increasingly important in today’s business landscape. Companies that innovate and operate sustainably often find better success and resilience. Integrating these principles into your business strategy post-Singapore Company Registration can set your business apart.

Conclusion

The process of incorporating a business entity in Singapore is just the beginning of a promising business journey in one of the world’s most dynamic and prosperous economies. By carefully selecting the right business structure, navigating the registration process with diligence, and planning strategically for growth, entrepreneurs can unlock vast opportunities in Singapore and beyond.

Singapore Company Registration not only offers a path to business success in a thriving market but also opens doors to global expansion, leveraging Singapore’s reputation as a global business hub. With the right approach and continuous commitment to compliance, innovation, and sustainability, businesses can flourish, contributing to Singapore’s vibrant economy and beyond.

Engage a corporate service provider like AG Singapore to help you with your company registration in Singapore. We are one-stop mid tier accounting firm in Singapore, providing incorporation service, accounting services, audit services and etc.