Singapore’s dynamic business environment offers a broad spectrum of types of business entities in Singapore, each catering to different business needs, from individual entrepreneurs to large multinational corporations. Singapore’s reputation as a global business center is well-deserved, thanks to its robust regulatory framework, attractive tax regime, and straightforward Singapore company registration processes. Entrepreneurs looking to set up their businesses in Singapore must navigate the decision of choosing the appropriate legal entity type. This choice is crucial, as it influences operational flexibility, tax obligations, personal liability, and the business’s ability to attract investment and grow.

Different Types of Business Entities in Singapore

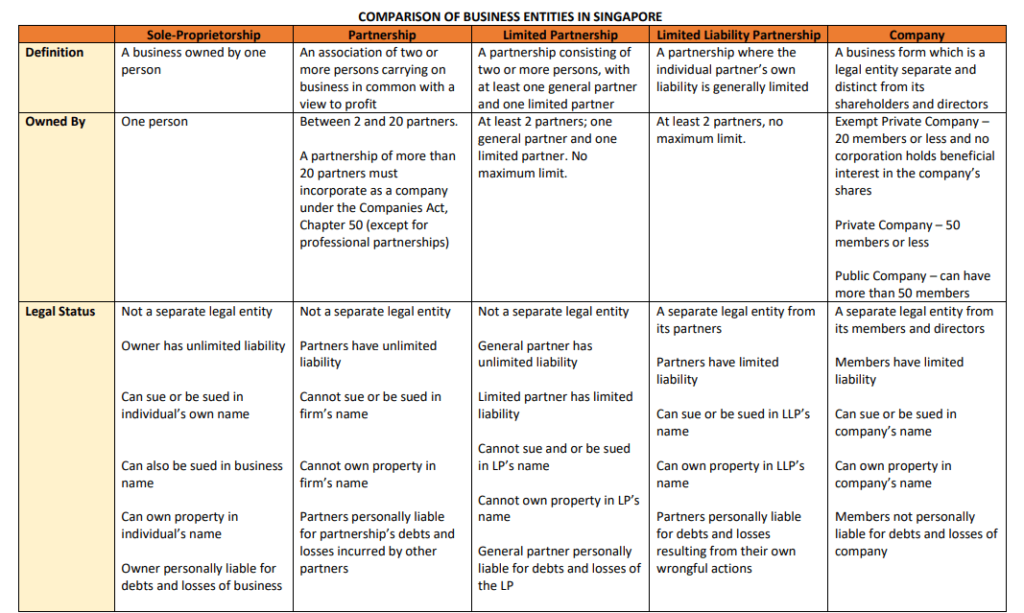

(Source: Comparison of types of business entities in Singapore by ACRA)

1. Private Limited Company

Among the types of business entities in Singapore, the most prevalent and preferred form of business entity in Singapore is the Private Limited Company (Pte Ltd).

- Limited Liability Feature: The company operates as a separate legal entity from its owners, safeguarding shareholders’ personal assets from business liabilities.

- Shareholder Capacity: Accommodates up to 50 shareholders, including both individuals and corporate entities.

- Ideal for Entrepreneurs: Perfect for those seeking scalability and flexibility in their business endeavors.

Advantages of a Private Limited Company

- Separate Legal Entity: Offers the ability to acquire assets, incur debt, enter into contracts, and sue or be sued independently of its shareholders.

- Limited Liability: Shareholders’ liability is confined to their investment in the company.

- Perpetual Succession: Ensures the company’s continuity despite changes in ownership or management.

- Ease of Raising Capital: Attracts investors and facilitates borrowing by maintaining a separation between personal and company finances.

- Credibility and Professional Image: Enhances the business’s standing among clients, suppliers, and financial institutions.

- Tax Benefits: Enjoys an attractive corporate tax rate and incentives, with no capital gains tax and a single-tier tax system.

2. Public Limited Company

Another type of company in Singapore is the Public Limited Company, which is designed for businesses looking to raise capital from the public. A Public Limited Company is designed for large-scale businesses, capable of raising capital by offering shares to the public. Such entities are subject to stringent regulatory requirements and are often listed on a stock exchange. Due to its complexity and the scale of operation, this entity type is beyond the scope of this article but is essential for businesses seeking significant growth and public investment.

3. Public Company Limited by Guarantee

Targeted at non-profit organizations, this entity type is utilized for operations that do not have a profit motive. It is particularly suitable for entities focusing on charitable, scientific, or artistic purposes.

4. Foreign Company Registration Options

Singapore offers several pathways for foreign entities looking to establish a presence, including setting up a Branch Office, Subsidiary, or Representative Office. Each option has its advantages, tailored to different business needs and objectives.

- Subsidiary Company: A popular choice for SMEs, offering limited liability and local tax benefits.

- Branch Office: Acts as an extension of the foreign parent company, without separate legal identity.

- Representative Office: Ideal for conducting market research, with no legal status for business transactions.

5. Sole Proprietorship

The Sole Proprietorship is another fundamental type of business entity in Singapore, offering simplicity and direct control for small business owners. However, this type of business entity in Singapore comes with the caveat of unlimited personal liability, making it a less attractive option for risk-averse entrepreneurs.

6. Partnership

Singapore recognizes three types of partnerships: General Partnership, Limited Partnership, and Limited Liability Partnership (LLP). Partnerships offer a way for two or more individuals to co-own a business, with LLPs providing a mix of partnership flexibility and corporate benefits, especially appealing to professionals like accountants and lawyers.

6.1. General Partnership

A General Partnership in Singapore is formed when two or more individuals (up to a maximum of 20) come together to conduct business with the aim of sharing profits. In this arrangement, each partner is jointly and severally liable for the debts and obligations of the business, without any limit. This means that personal assets can be used to settle business debts if the assets of the business are insufficient.

Key Characteristics:

- Unlimited Liability: Each partner can be held responsible for the full extent of the business’s debts and liabilities.

- Shared Management and Profits: Partners share the responsibility for managing the business and divide the profits according to an agreed-upon ratio.

- Joint and Several Liability: If one partner incurs debts or liabilities, all partners can be held liable.

This form of partnership is not incorporated as a separate legal entity, meaning the partners are the business. This setup might not be attractive due to the high level of personal financial risk involved.

6.2. Limited Partnership

A Limited Partnership introduces the concept of having one or more general partners with unlimited liability and one or more limited partners whose liability is restricted to the amount of capital they have contributed to the partnership. Limited partners are typically passive investors who do not participate in the day-to-day management of the business.

Key Characteristics:

- Mixed Liability: Combines the features of unlimited and limited liability within the same partnership structure.

- Passive Investment Opportunity: Allows investors to contribute to the business without being involved in management or being liable beyond their investment.

- Management by General Partners: Only general partners are involved in the management of the business, protecting limited partners from liabilities due to managerial decisions.

Despite offering a way to raise capital without incurring additional liability, limited partnerships are less popular due to the complexity and the fact that general partners still face unlimited liability.

6.3 Limited Liability Partnership (LLP)

The LLP is a more recent and sophisticated business structure that combines the features of partnerships and corporations. It allows professionals to form a partnership with a flexible management structure and limited liability for its partners, making it an attractive option for professional services firms such as accountants, lawyers, and architects.

Key Characteristics:

- Limited Liability for Partners: Partners are not personally liable for the business debts incurred by the other partners, protecting personal assets from business liabilities.

- Flexibility in Management: Unlike corporate entities, LLPs offer flexibility in management according to the LLP agreement among partners.

- Perpetual Succession: Similar to a corporation, an LLP has perpetual succession, meaning the partnership can continue despite changes in partnership or if a partner leaves.

An LLP is suited for businesses where professionals work together in a shared practice. It is important for partners to draft a comprehensive LLP agreement that outlines the management structure, profit sharing, and other operational aspects to prevent disputes and ensure smooth operation.

Making the Right Choice

Deciding on the appropriate business structure hinges on several factors, including the nature of the business, liability considerations, tax implications, and long-term goals. For most entrepreneurs, the Private Limited Company offers a balanced mix of benefits, from liability protection to tax advantages. However, individual circumstances and business objectives should guide the final decision.

Conclusion

Understanding the types of business entities in Singapore is essential for navigating the business landscape effectively. Each type of company in Singapore offers distinct advantages and limitations, making it important for business owners and entrepreneurs to carefully consider their options. Whether you opt for the flexibility of a Private Limited Company, the simplicity of a Sole Proprietorship, or the specific advantages of a Limited Liability Partnership, Singapore’s conducive business environment supports your entrepreneurial journey at every stage.

Company Formation Services

As a Singapore mid tier accounting firm in the realm of company registration and management, AG Singapore stands at the forefront of facilitating business establishment for entities across the spectrum in Singapore. We are dedicated to aiding businesses within this vibrant market by providing bespoke company registration solutions tailored specifically for Foreign Entrepreneurs, Foreign Companies, and Singapore Residents. Recognizing the critical role of compliance and financial transparency in today’s business environment, AG Singapore also extends comprehensive audit services. These services are designed to ensure that companies not only meet regulatory requirements but also maintain the highest standards of financial accuracy and integrity, laying a solid foundation for sustainable growth and investor confidence.

Why outsource to AG Singapore?

- OCBC Prestige Partner in Singapore: Recognized for outstanding corporate services.

- 5-Star Google Reviews: Achieved a top rating based on feedback from over 184 clients.

- Exceptional Track Record: Successfully incorporated over 200+ Private Limited (Pte Ltd) companies within a year.