Singapore, known for its robust economy and status as a business hub, presents lucrative opportunities for retail entrepreneurs. This article aims to provide an in-depth guide on starting a retail business in Singapore, leveraging the latest data and outlining the necessary steps and requirements for setting up a retail outlet. Whether you’re a local or an international entrepreneur, this guide offers valuable insights into navigating Singapore’s retail landscape.

Understanding the Retail Landscape in Singapore

Retail outlets are the front line of commerce, selling merchandise directly to consumers. In Singapore, the retail sector is a significant contributor to the economy.

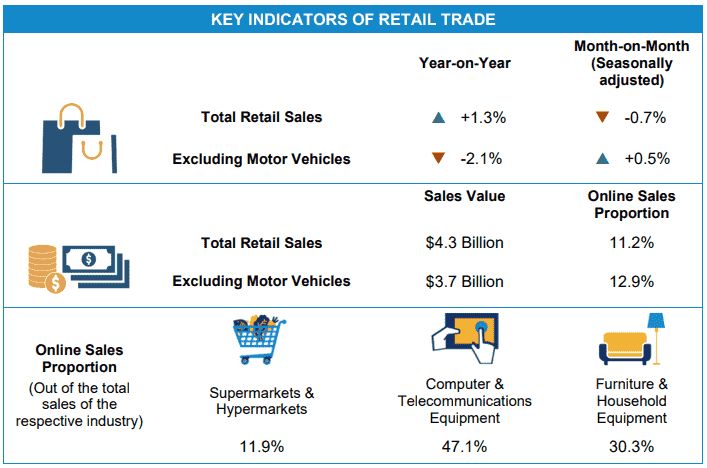

In January 2024, Singapore’s retail sector witnessed a 1.3% increase in sales compared to the same month the previous year, a notable rebound from the 0.5% decline recorded in December 2023. This uplift was largely propelled by a 37.3% surge in motor vehicle sales. However, excluding the automotive sector, retail sales dipped by 2.1%, albeit less severe than the 2.8% fall seen in December 2023. On a month-to-month basis, after adjusting for seasonal variations, January 2024 saw retail sales contract by 0.7%, but experienced a modest 0.5% uptick when motor vehicles were excluded from the calculation, in comparison to December 2023.

The overall estimated value of retail sales in Singapore for January 2024 stood at S$4.3 billion, with online transactions constituting 11.2% of this figure. This represents a slight decrease from the 12.8% share of online sales in December 2023. Stripping out motor vehicle sales, the total value of retail transactions was about S$3.7 billion, of which 12.9% originated from online sales. The penetration of online sales varied significantly across different segments, claiming 47.1% of total sales in the Computer & Telecommunications Equipment sector, 30.3% in Furniture & Household Equipment, and 11.9% in Supermarkets & Hypermarkets, highlighting the growing importance of e-commerce within Singapore’s retail landscape.

Setting Up a Retail Outlet

Retail Business Incorporation in Singapore

Before setting up a retail outlet in Singapore, you must register your business with the Singapore Companies Registrar, ACRA. Singapore’s business-friendly environment ensures a swift registration process, usually completed within 24 hours online. It’s crucial, however, to offer unique products or services to stand out in the competitive market.

Read also: types of business entities in Singapore

Singapore Entrepreneur Visa

For international entrepreneurs, obtaining the Singapore Entrepreneur Visa (EntrePass) is essential for relocating and managing your business during its initial stages.

Approval for Premises

Your business premise must comply with regulations, requiring approval from the Urban Redevelopment Authority (URA) for any modifications. Additionally, a Fire Safety Certificate from the SCDF confirms your outlet meets fire safety standards.

Licenses for Setting Up a Retail Outlet in Singapore

The type of merchandise you plan to sell dictates the licenses needed. This section covers requirements for supermarkets, pharmacies, and telecommunications stores.

Supermarket Licence

To operate a supermarket, you must adhere to Supermarket Licence guidelines under Singapore Food Agency. This process takes about five working days and requires detailed plans of the premises.

Pharmacy Licence

Operating a pharmacy requires a Certificate Of Registration from the Health Sciences Authority (HSA), with a detailed application process including an audit and a fee of S$500. The certificate is valid for one year.

Telecommunications Dealer’s Licence

Selling telecommunication equipment necessitates obtaining a Dealer’s Licence, with an application fee of S$50 for a Class Licence and S$250 for an Individual Licence, the latter being valid for five years.

Licences/Requirements To Retail Certain Goods

Selling cosmetics or liquor involves specific licenses due to their impact on health and safety. The sale of intoxicating liquor requires a licence from the Liquors Licensing Board, and cosmetic products must be notified to the HSA before market placement.

Obtaining a Liquor License

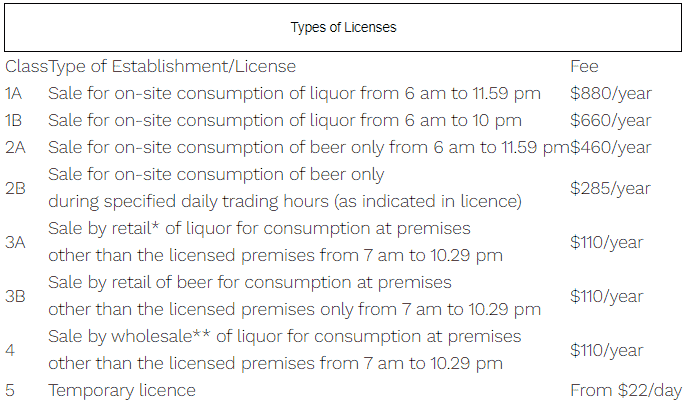

Securing the appropriate liquor license for your retail business in Singapore involves understanding the specific requirements that depend on various factors. These include the type of alcoholic beverages you plan to sell, the hours during which you intend to sell these beverages, and the nature of your establishment (e.g., a bar that serves alcohol on-site or a convenience store that allows both on-site and off-site consumption).

Your business’s specifics will dictate the necessary license, ranging from licenses that cater exclusively to beer sales to more comprehensive licenses for selling liquor in general. The operating hours of your establishment and the nature of your business (such as a bar versus a convenience store) will further influence the type of license required.

Holders of Class 3A, 3B, or 4 liquor licenses have the flexibility to deliver liquor outside the trading hours specified in their license, provided these deliveries are to private locations like homes or offices. It’s also possible to apply for multiple licenses across different classes, with the caveat that holding a Class 2A or 2B license precludes obtaining a Class 3A license for the same venue.

Application Criteria

To be eligible for a liquor license, applicants must:

- Have their business registered with ACRA, except for Class 2B license applications or those representing a registered society, which requires registration with the Registry of Societies (ROS).

- Be a Singapore Citizen or Permanent Resident with a FIN issued by the Immigration and Checkpoints Authority (ICA).

- Hold a position as a director of the company, a partner in the partnership, or the sole proprietor.

- Demonstrate that they are “fit and proper” for holding a license.

The “fit and proper” assessment considers factors such as past convictions, compliance with previous liquor licenses, cooperation with police investigations related to liquor licenses, and any history of license cancellations or suspensions.

Application Process

The application process is streamlined through the GoBusiness Licensing Portal, where the required fees based on the license class must be submitted. The fee structure varies according to the class of license being applied for.

During the application process, you may need to provide additional documentation, including:

- ACRA Certificate

- Copy of NRIC or Foreign IC for non-Singaporeans with a work permit

- Planning permission for land use from the Urban Redevelopment Authority (URA)

- Copy of the hawker’s license for outdoor stall applicants

- Certificate from the Registry of Societies (ROS) for registered societies

The outcome of your application will be communicated within twelve business days via SMS or email, based on the contact information provided in the application.

Choosing and Preparing Your Premises

Identifying the right location involves more than just considering customer footfall and accessibility; the space must comply with safety standards and governmental building regulations.

To modify the shop’s structure, a permit from the URA and a building work permit from the Building and Construction Authority of Singapore (BCA) are necessary. Prior to occupying the space, a Certificate of Statutory Completion and a Temporary Occupation Permit (TOP) from the BCA are required.

Qualified personnel (QP) must conduct any renovation work. For the installation of business signage, an Advertisement License from the BCA is needed.

Minimal modifications may suffice for converting a non-retail space into a retail outlet. For instance, transforming a former school into a retail space could require only minor renovations to meet the basic requirements for retail operation.

If no renovations are needed, securing a Change of Use permit from the Urban Redevelopment Authority is essential to officially designate the location for retail purposes.

Hiring Staff

According to the Employment Act, foreigners need to hold a valid work pass to work in Singapore. If you intend to employ a foreign national, it’s necessary to secure an appropriate work pass or work permit for them before they can start their job. Be aware that some types of work passes impose limits on the total number of foreign workers you can employ.

Read also: Types of Work Passes In Singapore

Conclusion

Starting a retail business in Singapore involves navigating legal requirements and market dynamics. While the process is streamlined, the competitive landscape demands a unique business proposition. Hiring a professional accounting firm can expedite the setup and licensing, allowing you to focus on building a successful retail outlet. For further assistance, consider consulting Singapore company incorporation services to ensure a smooth start to your retail venture.

Singapore’s retail sector, rich with opportunity, awaits the entrepreneur ready to dive into its vibrant market. With the right preparation and adherence to regulations, your retail business can thrive in this dynamic environment.