In the fast-paced and ever-evolving business landscape, companies of all sizes are continuously seeking to optimise their business operations and maximise their profitability.

One key area that businesses often grapple with is accounting, such as managing financial data, general bookkeeping, and taxation, as it can be complex and time-consuming.

Not to mention, accounting has to be carried out according to the requirements specified by the Accounting and Corporate Regulatory Authority of Singapore (ACRA).

As such, many business owners would prefer getting outsourced accounting services instead of hiring and training employees. But does outsourcing accounting really make more sense than hiring an in-house professional accountant?

In this article, we will delve into the advantages of outsourcing accounting services and why it has become an increasingly popular choice for the corporate world.

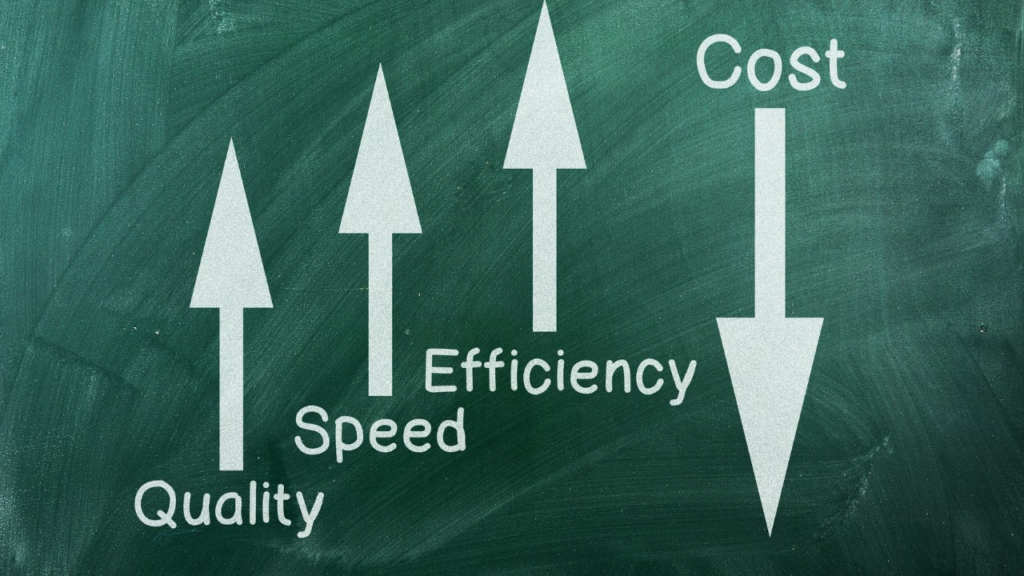

Cost Efficiency of Outsourced Accounting Services

This is the major reason why most businesses would rather have an outsourced accounting firm than hiring and maintaining an in-house accounting department. Employing an accounting team can be expensive as you need to pay for:

- salaries

- benefits

- training

- office space

- technology infrastructure

- and possibly more!

On the other hand, outsourcing allows you access to experienced professionals without the overhead costs, as most accounting firms typically charge a fixed fee or hourly rate.

Expertise and Experience

Another major advantage of outsourcing accounting and bookkeeping services is you can access the expertise and experience that come from handling complex accounting tasks across various industries.

Furthermore, these experts stay updated with the latest industry regulations, accounting standards, and tax laws, ensuring that your financial records are accurate and compliant.

By utilising their knowledge, you reduce the risk of errors, financial mismanagement, and costly regulatory penalties.

Scalability

As your company grows, so does the size of every department, especially accounting. The numbers may even reach a figure you have never handled before.

Therefore, hiring an outsourced accounting service serves as a scalable solution for businesses.

You can adjust the level of service to meet your specific needs and easily expand the scope of outsourced services without the hassle of hiring and training additional in-house staff. Conversely, during slower periods, you can reduce your outsourcing requirements to save costs.

This flexibility is a significant advantage for businesses experiencing fluctuating workloads.

Focus on Core Business

When you outsource accounting services, you free up valuable time and resources that can be redirected towards your core business activities.

Instead of digging through financial paperwork and transactions, you can concentrate on strategic tasks, such as business development, financial planning, future projections and investments.

This improved focus on your primary business functions can result in increased productivity and revenue.

Enhanced Data Security

Reputable outsourced accounting firms invest heavily in stringent data security measures against cyber threats and breaches, which is essential as clients will use not only their cash flow information but also confidential data.

This level of security is often challenging for companies to achieve on their own, particularly if you are a small business.

By outsourcing, you benefit from advanced security measures without the need to invest in expensive IT infrastructure and expertise.

Access to Advanced Technology

Accounting software and technology are continually evolving, which would incur a costly expense if you were to train an in-house accounting team.

Yet, it is a different story if you outsource accounting, as these providers are well-equipped with the latest accounting software and tools, ensuring efficient and accurate financial management.

By outsourcing, you gain access to cutting-edge technology without the financial burden of purchasing and maintaining these systems.

Improved Risk Management

Outsourcing accounting functions can enhance your risk management efforts as expert accountants can identify potential financial risks, recommend strategies to mitigate them and ensure that your business adheres to regulatory requirements.

Therefore, partnering with an outsourced accounting team can bring you similar benefits to hiring financial advisors.

You can make more informed financial decisions and protect your business from unforeseen financial setbacks which may contribute to your company’s financial advancement.

Secure Your Financial Future with AG Singapore’s Outsourced Accounting Services

Ready to elevate your business with top-tier accounting expertise?

Embrace the strategic growth, compliance, and risk management that AG Singapore promises!

Our award-winning accounting firm offers flexible outsourced accounting services to meet your unique business demands, delivering detailed reports that fuel informed decisions and boost investor confidence.

With a steadfast commitment to excellence, we ensure your accounting deliverables are in your hands within 30 days—or you’ll receive your money back, guaranteed.

Take the decisive step towards flawless financial management; contact AG Singapore today and solidify your company’s financial future!