When considering expansion or launching new ventures in Southeast Asia, the choice between Singapore and Malaysia is pivotal. This comprehensive analysis will explore the economic landscapes, workforce capabilities, business incorporation processes, and financial incentives in both nations, providing crucial insights for investors and business owners.

Economic Overview: Paths of Diverging Prosperity

Singapore and Malaysia offer distinct economic advantages reflective of their development strategies and roles within the ASEAN economy. Here’s a closer look:

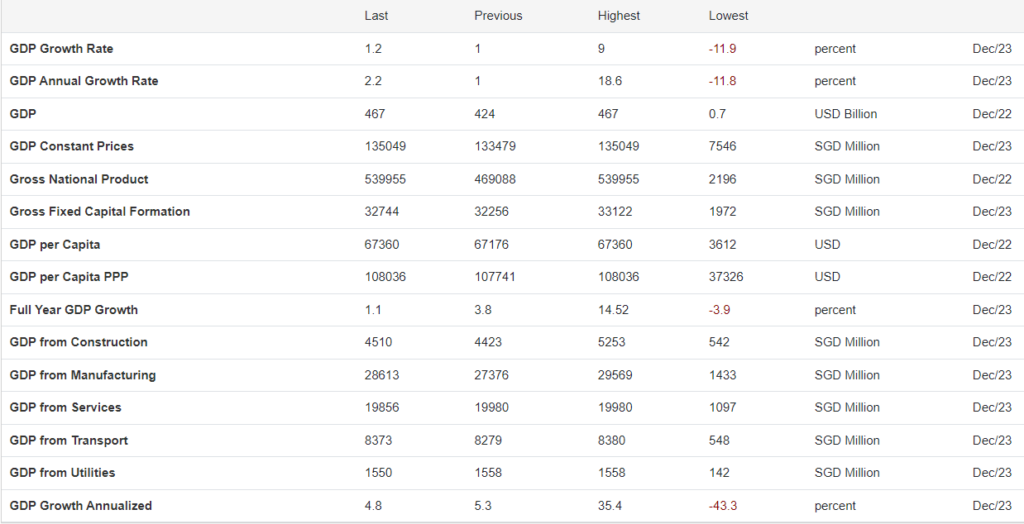

- Singapore:

- Recognized as a leading global financial center with a high GDP per capita.

- The economy is bolstered by sectors such as finance, manufacturing, and trade.

- A strategic location and a pro-business environment attract a plethora of multinational corporations.

- Malaysia:

- Features a diverse economy with strengths in agriculture, manufacturing, and services.

- A major exporter of palm oil, electronics, and natural gas.

- Despite a lower GDP per capita compared to Singapore, Malaysia shows significant economic growth supported by its vast workforce and natural resources.

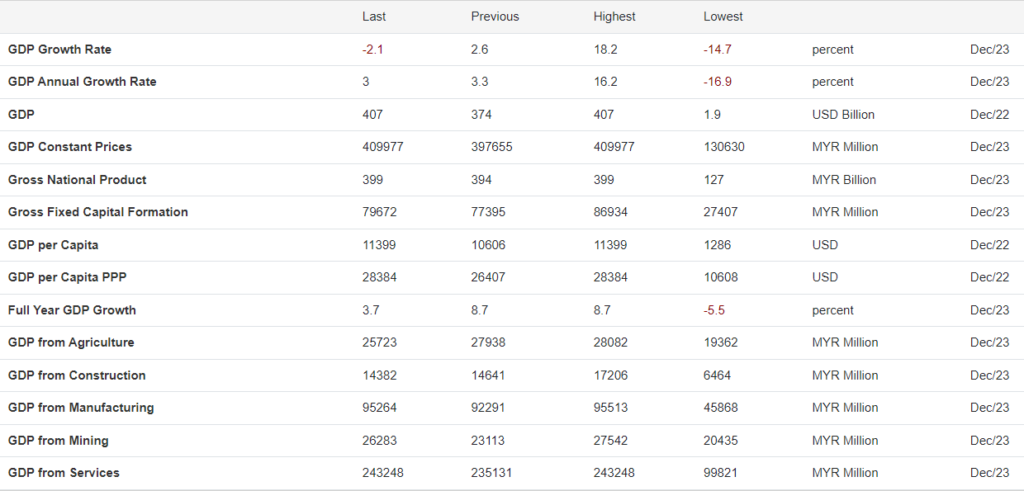

Workforce and Education: Cultivating a Competitive Edge

The human capital in both countries underpins their economic vigor:

- Singapore:

- Despite its smaller population, it leverages technology and innovation for productivity and competitiveness.

- High labor force participation rate at 70.0%.

- The average monthly salary stands at SGD 6,153, indicative of its developed economy and high living standards.

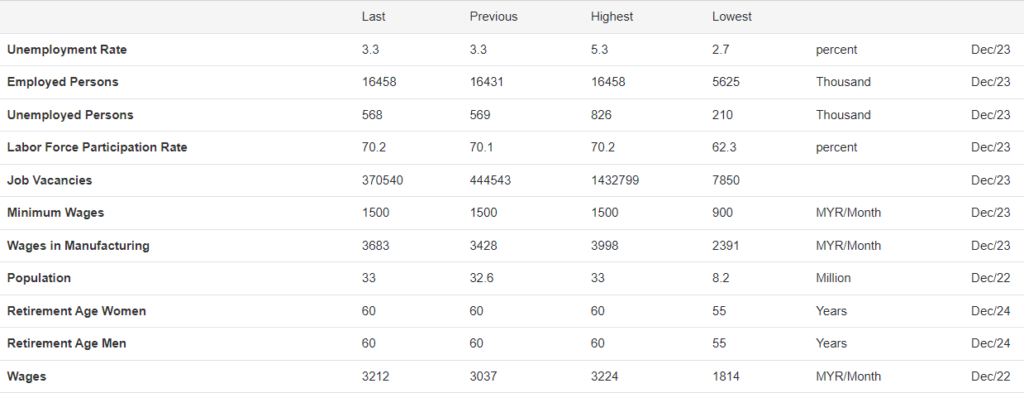

- Malaysia:

- With a larger population base, it offers a significant labor market advantage.

- Slightly higher labor force participation rate at 70.2%.

- The average monthly income is RM 3,212, reflecting its diverse economic base and growth potential.

Incorporation and Set-Up: Navigating Business Structures

Both countries present attractive opportunities for business structures, but with notable differences:

- Business Structures Available:

- Private Limited Company

- Limited Liability Partnership

- Branch Office

- Representative Office

- Subsidiary

- Sole Proprietorship

- Singapore:

- Incorporation can be completed within a day.

- Allows 100% foreign ownership, offering straightforward options for international investors.

- Requires only one resident director and one shareholder for company setup.

- Malaysia:

- The process might take two to three days.

- Foreign ownership above 30% requires approval from a foreign investment committee.

- At least two resident directors and two shareholders are needed, though one person can fulfill both roles.

Taxation and Financial Incentives: Enhancing Business Viability

Both nations offer compelling incentives for businesses:

- Singapore:

- Startups earning less than S$200,000 annually can enjoy the full exemption scheme for the first 3 years (a 75% exemption on the initial $100,000 of standard taxable income; followed by an additional 50% exemption on the subsequent $100,000 of standard taxable income).

- Partial tax exemption for resident companies on the first S$300,000 of taxable income each year, with a reduced tax rate of approximately 8.5%.

- The government provides various grants and schemes to foster innovation.

- Malaysia:

- Offers Pioneer Status, granting up to 70% tax exemption on statutory income for 5 to 10 years, depending on the business nature.

- The Investment Tax Allowance benefits companies making substantial capital investments, promoting industrial expansion and modernization.

Strategic Business Decisions: Weighing Your Options

The decision to opt for Singapore or Malaysia hinges on various factors. Here’s a summary to guide this crucial choice:

Singapore:

- A mature market with a sophisticated financial services sector.

- Ideal for businesses seeking a competitive edge through innovation and regulatory expertise.

- Offers an efficient and flexible business environment with significant tax advantages.

Malaysia:

- Attracts businesses with its cost efficiency and industrial diversity.

- Suitable for companies looking to leverage a large workforce and natural resource base.

- Provides substantial incentives for investment and growth in promoted sectors.

Conclusion: Navigating Southeast Asia’s Business Landscape

Doing Business in Singapore vs Malaysia requires a nuanced understanding of each country’s unique offerings. Singapore’s position as a financial powerhouse and its conducive business environment make it a preferred destination for businesses aiming for rapid growth and global competitiveness. On the other hand, Malaysia’s economic diversity and strategic incentives present opportunities for cost-effective expansion and engagement in a range of industries.

Investors and business owners must align their strategic priorities with the advantages each country offers. Whether it’s Singapore’s advanced financial sector and streamlined business processes or Malaysia’s vibrant economy and supportive incentives, the choice will significantly impact the trajectory of your business venture in Southeast Asia.

Company Registration

To facilitate the business registration process, you can engage a local accounting firm like AG Singapore to assist. We are an one-stop mid tier accounting firm in Singapore and provide company incorporation services to SME, including accounting services, audit services, tax services and other compliances.

Why outsource to AG Singapore?

- OCBC Prestige Partner in Singapore: Recognized for outstanding corporate services.

- 5-Star Google Reviews: Achieved a top rating based on feedback from over 184 clients.

- Exceptional Track Record: Successfully incorporated over 200+ Private Limited (Pte Ltd) companies within a year.