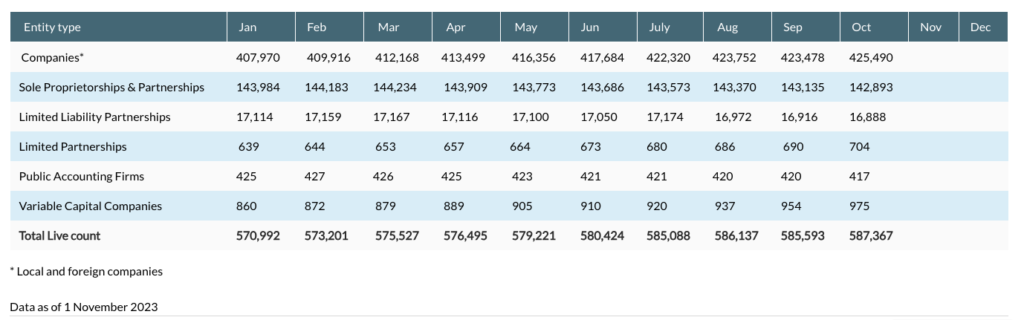

Singapore’s business environment is thriving more than ever, as highlighted by the recent report from the Accounting and Corporate Regulatory Authority (ACRA). As of October 2023, an impressive total of 587,367 business entities are registered in the city-state. This figure translates to an intriguing statistic: there is more than one business for every ten residents in Singapore.

The growth of new enterprises is a constant in Singapore’s dynamic economy. In 2023 alone, an average of 5,000 to 6,000 new businesses were registered each month. Among these, companies constitute the majority, with 425,490 out of the total 587,367 businesses. However, a substantial number of sole proprietorships and partnerships, totaling 142,893, also play a crucial role in Singapore’s business ecosystem.

Source: ACRA

For those considering launching a business in Singapore, understanding the differences between companies, sole proprietorships, and partnerships is vital. Moreover, it’s essential to discern which structure aligns best with your business goals. The Start-Up Guide available on the GoBusiness website offers a comprehensive analysis of these business structures, alongside a detailed guide for starting a business in Singapore. Below, we delve into the three most common business structures in Singapore, offering insights for aspiring entrepreneurs.

Business Registration: Sole Proprietorship

The sole proprietorship is the simplest business structure, where an individual owns and operates the business. This structure allows the owner complete control and minimal compliance requirements. Business owners in this structure are only required to renew their registration annually. The profits are taxed as personal income, and there’s no need for Annual General Meetings, financial statements, or mandatory audits. However, sole proprietors are personally liable for all business debts and legal consequences.

Business Registration: Partnerships

A partnership is akin to a sole proprietorship but involves two or more individuals (up to 20). This category includes Limited Partnerships (LP) and Limited Liability Partnerships (LLP). In an LP, there must be at least one general and one limited partner. The general partner holds responsibility for the LP’s actions, whereas the limited partner’s liability is confined to their contribution. An LLP, on the other hand, forms a separate legal entity, with partners not personally liable for each other’s actions. LLPs must maintain accurate books of accounts and annually declare their financial status.

Business Registration: Companies

Differing from sole proprietorships, companies are separate legal entities with distinct identities. They can own property, have perpetual succession, and can engage in legal actions. Companies, especially the prevalent private limited companies, face more governance requirements. These include appointing a qualified secretary, at least one resident director, filing annual returns, and keeping financial records for five years. A key advantage of private limited companies is their ability to issue shares and limit liabilities to the shareholders’ capital investment.

In conclusion

Singapore’s business landscape is marked by diversity and opportunity. Whether you opt for the simplicity of a sole proprietorship, the collaborative nature of a partnership, or the structured approach of a company, understanding these structures is fundamental to your business registration journey in Singapore.

To facilitate the business registration process, you can engage a local accounting firm like AG Singapore to assist. We are an one-stop mid tier accounting firm in Singapore and provide company incorporation services to SME, including accounting services, audit services, tax services and other compliance services.