Receive Professional Audits FAST In 30 Days

Ackenting Group (AG) is an award-winning mid-tier audit firm in Singapore, trusted by SMEs and growing enterprises for reliable, compliant, and insight-driven audit services.

We specifically focus on audit service engagements that we are able to complete within 30 days to help SMEs meet tight audit reporting deadline without delay.

Our key offerings include:

- Audits conducted in full accordance with SFRS and Singapore Standards on Auditing (SSAs)

- Only ACRA-certified auditors leading every engagement

- Over 2,000 successful audit engagements completed across diverse industries

Audit Filing Requirements

Under the Companies Act, all private limited companies in Singapore are required to comply with statutory audit requirements under local regulations. However, the exact audit obligations depend on the size, revenue, and structure of the business.

All companies, including small and non-listed companies, must file annual returns (AR) with ACRA. Non-listed companies have up to seven months after the end of their financial year to submit their AR. If an AGM is held, the AR must be filed within one month after the AGM. If an AGM is not required, the AR must still be submitted no later than 7 months after the financial year-end.

When submitting financial statements, most companies must file them in XBRL format. However, Exempt Private Companies (EPCs) and dormant companies may qualify for simplified filing requirements or declaration-based submissions, instead of submitting full XBRL financial statements.

But not all companies are required to undergo a statutory audit. Companies that qualify as a small company may be exempt from audit if they meet at least two of the following conditions for two consecutive financial years:

While an audit may not be mandatory, it remains important for companies to prepare financial statements in compliance with Singapore Financial Reporting Standards and to maintain proper accounting records. This helps ensure accurate reporting, supports regulatory compliance, and provides greater transparency into the company’s financial position.

To ensure a smooth audit process, companies are required to maintain accurate and up-to-date documentation. Commonly required documents include:

Timely completion of audit filing obligations helps businesses avoid regulatory issues, maintain good standing with authorities, and build credibility with banks, investors, and stakeholders. Regular compliance also ensures that financial records remain accurate, transparent, and suitable for future growth or funding requirements.

Audit Services We Provide in Singapore

Statutory Audit

BCA Audit

Sales Audit

Grant Audit

Internal & External Audit

Lucky Draw Audit

MCST Audit

Charities Audit

Group Consolidation & Amalgamation Audit

Get Your Accounts Audited by

OCBC Prestige Partner

Nothing is better than having your accounts trusted by banks

Our Tailored-made Fast Audit Process

Our audit process ensures compliance, accuracy, and minimal disruption to your operations.

Step 1: Audit Planning

Our auditors work closely with you to understand your business, financial structure, and risk areas. From these insights, they define the audit scope, objectives, and timeline.

Step 2: Audit Initiation

Then the auditors formally initiate the audit, communicating key details, including documentation requirements, timelines, and coordination points, to management.

Step 3: Opening Meeting

An opening discussion is held with relevant stakeholders to align expectations, responsibilities, and audit objectives before fieldwork begins.

Step 4: Audit Fieldwork

Our auditors review financial records, supporting documents, and internal controls. This includes transaction testing and verification against statutory requirements.

Step 5: Draft Audit Report

Based on the findings, a draft audit report will be prepared that highlights observations, risks, and recommendations.

Step 6: Management Review & Finalisation

Management reviews the draft report and provides responses or clarifications. The audit report is then finalised accordingly.

Step 7: Audit Closure

The final audit report is issued. Then, if required, our auditors offer follow-up support to address agreed action points.

Audit Service Fee

*If you are looking to get your audit report fast but with a reasonable premium fee, AG is definitely your top option.*

Our audit service fees are based on the nature and complexity of each audit engagement. We only accept maximum 100 new audit engagements a year so that we are committed to our KPI of audit completion within 30 days.

| Starting from | |

| Statutory audit services | S$3,000 |

| Sales audit services | S$800 |

| Other special audit services | Varies (ask for a quote) |

How long is the audit timeframe for completing statutory audit services?

When it comes to statutory audit services in Singapore, our auditing firm specifically caters our auditing approach to expedite audit services. We also ensure completion within 30 days without compromising on quality, as per our Key Performance Indicator (KPI). Terms and conditions apply.

Benefits of Local Audit Services

Gain a competitive edge through our company’s audit services in Singapore:

No more waiting months

to get your financial statements audited

Expedited Audit Process: 30 Days KPI

Our Approach

Our team also ensures completion within 30 days without compromising on quality, as per our Key Performance Indicator (KPI). Terms and conditions apply.

With over 2000 audit services completed, our expertise allows us to accurately assess timelines and provide transparent expectations to clients upfront. We follow a structured, risk-based methodology that allows us to identify key focus areas early, address compliance obligations efficiently, and minimise disruption to your day-to-day operations.

What sets our approach apart

- Strong technical expertise: You ensure that our professionals have in-depth knowledge of audit standards, regulations, and industry practices.

- Risk-focused methodology: We concentrate on areas that matter most to your business, financial health, and internal controls.

- Practical and business-oriented: Our recommendations are clear, actionable, and aligned with real operational needs.

- Compliance-driven, not compliance-only: Beyond meeting statutory requirements, we help strengthen internal processes and governance.

- Client-centric execution: We work closely with management teams to ensure transparency, responsiveness, and smooth coordination throughout the audit process.

AG Audit Team

Our audit team is made up of 20+ audit professionals ready to serve you.

Successful Audit Case Study

AG Audit Services

Meet Your Group Audit Needs

Backed by IR Global Network Members in 155+ Jurisdictions

93% of clients picked our auditing services

because we met their audit deadlines within 30 days

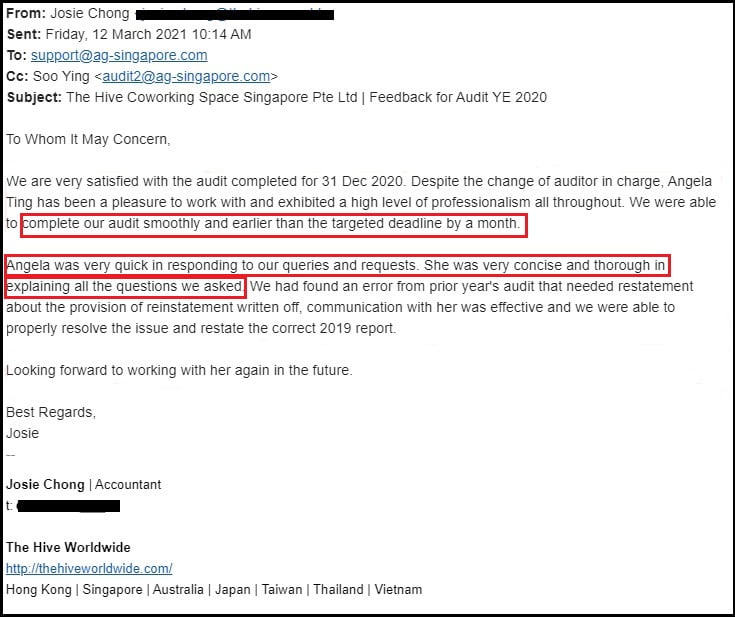

”Completed audit smoothly earlier than the targeted deadline by 1 month.”

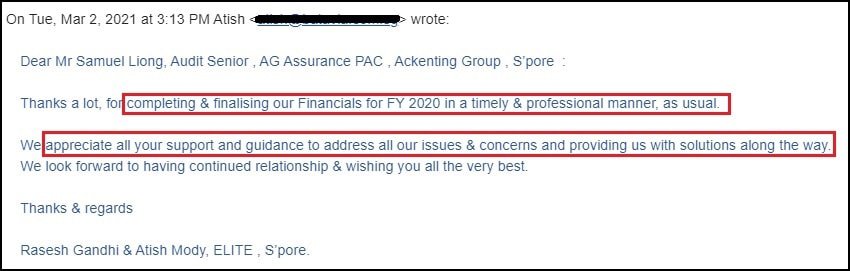

”Completed and finalised audit in a timely and professional manner as usual.”